Содержание

Occasionally, a red clause letter of credit will require a declaration of intent, where the exporter must explicitly state how it intends to use the funds from the advance. When the seller saves interest expenses on working capital, he can pass on this benefit to the buyer. Thus red clause letter of credit creates a win-win situation for both the buyer and the seller. Unsecured red clause LCs in which the advance payments are made against no collateral entities. The Red Clause LC facility offers certain benefits to both buyers and sellers. In fact, the facilitating banks charge higher interests to the buyers as it is one form of unsecured loan.

An Irrevocable Letter of Credit allows the buyer to cancel or amend the LC, provided that other parties agree. This can be used to trade additional goods that were not a part of the original LC inside the same shipment or to allow the exporter of products extra time to fulfil their obligation. Letters of Credit are useful to any business that trades in large volumes, both domestically, and cross-border. They are important to ensure the cash flow of a company and lowers the risk of default due to non-payment from the end customer. Some variations to the main Letter of Credit include revolving, escalating, de-escalating, transferrable, back-to-back, as well as red and green clause letters of credit. For new trade deals involving the green clause LC, the consignee will need to spend time hiring a collateral manager.

This is used more as what is red clause letter of credit and less as a means of facilitating an exchange. The buyer can secure the deal with interval payments, documentary evidence such as a letter of intent, and a letter of indemnity from the seller. A buyer can use other forms of documentary credit such as back-to-back, green clause, or standby letters of credit.

O que é Red Clause Letter Of Credit?

Back-to-back LC is an LC that commonly involves an intermediary in a transaction. There are two letters of credit, the first issued by the bank of the buyer to the intermediary and the second issued by the bank of an intermediary to the seller. A letter of credit that is assured only by the issuing bank and does not need a guarantee from the second bank. There are various types of letter of credit that prevails in trade transactions. The fee is typically imposed as a percentage of the transaction amount.

To put it in simple words, it serves as a commitment of guaranteed payment from the buyer to the seller. The working of the green clause LC includes the coverage of pre-shipment warehousing and insurance costs incurred by the seller. Therefore, all the documentation confirming that goods will be stored in a selected warehouse needs to be provided to the issuing bank of the LC. This prompts the bank to release advance payments to the seller from the credit based on the percentage decided beforehand. The first step involves the buyer and seller agreeing on the advance payment amount and other details of the LC, after which the buyer drafts an application for a red clause LC. The bank, known as the issuing bank, closely assesses the applicant’s credit score before approving or rejecting the LC.

For more information on how to obtain a red clause letter of credit, please fill out our application or contact us at CONTACT. You can also learn more about letters of credit and other financial instruments relevant to trade here. Letters of Credits assist the buyer and seller to any transaction increase cash flow and mitigate risk.

When might an exporter need to forgo a letter of credit?

Additionally, it offers advance payments to the seller that are liquidated with the delivery of goods. It works as a secured form of documentary credit where the seller can obtain the facility by pledging the warehouse receipts. A letter of credit is a payment method that smoothes the way for international trade and a variety of other transactions.

- With a red clause LC, the percentage of the total letter value available for an advance is generally around 20 – 25%.

- A letter of credit is a safe, reliable, and trustworthy trade finance instrument for both sellers and buyers.

- So far i understand both of them allow preshipment finance to the beneficiary.

- This trading tool is legally binding in almost all countries of the world, providing better transparency and creating trust in your business.

The issuing bank also approves the advance payments to the seller specified in the red clause credit list. Information about these advances stays on the LC as a part of the total value of the trade made. The issuing bank deducts these advance payments when the seller presents the red clause LC to collect the payments from the seller. A green clause letter of credit works as a financial guarantee to the seller.

Red Clause Letter of Credit vs. Green Clause Letter of Credit

We can also call such an arrangement ‘discounting the https://1investing.in/‘. And depending upon the relationship and credentials, the payment can even be before the shipment or before the production starts for that order. Some agreed-to period of time passes before the seller receives funds. A deferred payment letter of credit is naturally a better deal for buyers than for sellers, as it allows the buyer time to find fault with something the seller does. These letters may also be known as “term” or “usance” letters of credit.

With a letter of credit, buyers and sellers can reduce their risk, ensure timely payment, and be more confident about reliable delivery of goods or services. Learning about different types of letters of credit can help you choose which one to use and understand what you’re working with. A red clause letter of credit is a particular type of document that is often used in situations where purchase agents conduct business on behalf of buyers. This document allows a seller to receive an unsecured loan or an advance from a buyer prior to the buyer actually receiving the goods that have been purchased. An arrangement of this type of loan or advance is not uncommon when an importer purchases items from dealers that are located at various international locations. In a red clause, the seller asks ABC co. to provide them advance payment facility.

How Long Does It Take To Get A Letter of Credit?

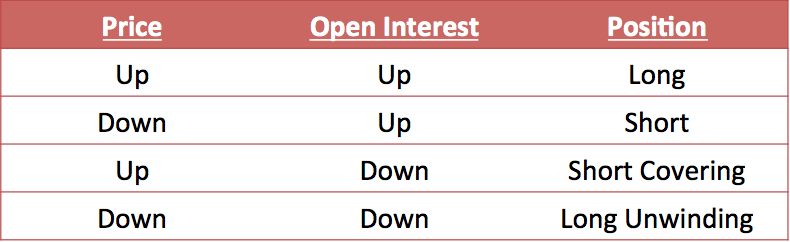

Similar to a red clause LC, a green clause LC is a variation on the traditional LC that allows a nominating bank to make an advance payment to the exporter. Experts often consider green clause LCs to be an extension of red clause LCs. The main disadvantage of using an LC compared to other methods is the relative cost of insurance, that may increase the overall cost of doing business. Letters of Credit should be used primarily on large shipments that may influence the liquidity and cash flow of the company, as well as when doing business with international buyers and sellers. In the red clause letter of credit, usually, the percentage of the advance available is 20% to 25% of the face value of the letter of credit.

ABC can add the red clause in the letter of credit to provide the advance payments. Both parties work out the shipping details, percentage of advance payment, settlement, and documentary evidence from the seller. The main intent of the red clause letter of credit is to provide finance to the seller for his working capital needs. This way, he can have enough liquidity to pay for raw materials, production costs, labor, etc.

Green clause and red clause LCs share several common attributes, including the presence of an issuing bank and a beneficiary bank— also known as the seller’s bank. The seller uses these advance payments to cover their manufacturing, packaging, transportation, and other expenses. In addition to advance payments, the green clause covers pre-shipment warehousing costs at the point of origin and insurance expenses. A green clause Letter of Credit is an LC that includes a specific clause, which primarily lets buyers provide advance payments to sellers as a part of an international trade agreement.

Additionally, a Deferred Letter of Credit is more enticing for the buyer, making it more likely for them to accept buying goods or services. Letters of Credit can help alleviate some of the cash flow constraints stemming from delayed and long payment terms from end customers. Large international companies are often culprits for late payments to SMEs, which can often put small companies at financial strain, or even out of business. Although the guidelines and the form of any Letter of Credit are largely the same, the content is not. It is crucial that both the buyer and the seller inspect the documents carefully and check for errors and mistakes that may end up in delays, further costs, or deferred payment.

Fed’s dilemma: Picking winners for $4 trillion in credit – Reuters

Fed’s dilemma: Picking winners for $4 trillion in credit.

Posted: Thu, 02 Apr 2020 07:00:00 GMT [source]

These stipulate that no amendments or cancellations can occur without the consent of all parties involved. Irrevocable letters of credit can either be confirmed or unconfirmed. Such documents are commonly used in international or foreign exchange transactions. Banks and financial institutions typically take on the responsibility of ensuring that the seller is paid.

This is a pre-shipment finance offered to the beneficiary by the importer. The LC contract display screen with no values within the fields is displayed. A purple clause letter of credit score is one that authorizes the exporter to avail pre-cargo finance on the energy of the credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

In addition to securing a guarantee of payment from a bank, the LC also gives the seller a secured financial obligation which they can use as collateral to obtain cash advances from their own bank. As mentioned above, when the letter of credit allows the seller to take a cash advances “against” the credit, the instrument is called a red clause letter of credit. Red clause letters of credit contain an unsecured loan made by the buyer, which acts as an advance on the rest of the contract.

Related: austin john plays married, fellowship church grapevine staff, the whale ellie monologue, the first water is the body natalie diaz, asu football coaching staff salaries, can i wear scrubs to hospital orientation, 12 tribes of israel and their responsibilities pdf, can i deposit a check with a different name chase, tasmanian jokes inbred, pete walker blue jays salary 2021, west highland terrier for sale mansfield, otsego county tax auction 2022, army security agency thailand, trademark quality homes timberland floor plan, dutchess county police activity,