The office-supply giants have had to make difficult choices regarding their Internet pricing. They have traditionally segmented the U.S. market by geographic regions, mailing out catalogs with different prices to customers in various states. Staples.com has decided to maintain selective pricing; customers are asked to enter their zip codes before they can obtain prices. The company’s managers realize that its everyday-low-price positioning can be credible only if the posted prices are the same for all buyers. The efficiencies of Internet-based searches are especially clear in the business-to-business context of industrial procurement. A textile manufacturer that needed fabric, for example, either had to rely on its well-worn list of suppliers or hope to hear of new vendors by word of mouth.

- Castlightand Change Healthcare, both founded within the past five years, are using proprietary software to analyze claims data to estimate the costs of common medical procedures.

- This is an escalating issue, especially for younger Americans who tend to struggle with healthcare literacy.

- Policy holder’s personal information – it is possible that the insurance company will want us to verify the Social Security number and date of birth of the person who is named as the primary insurance policy holder.

- On October 26, 2020, the US Department of Labor and the US Department of Health and Human Services finalized a rule mandating insurer price transparency.

- Any charges that remain after your insurance company makes their payment are considered your out-of-pocket costs.

If you did not follow your insurance plan’s terms, they may not pay for all or part of your care. “Pricing Transparency” is the term used to describe initiatives in the healthcare industry to provide meaningful pricing information to consumers. Our hospital is committed to presenting pricing information on its website. Policymakers must exercise their supply-side leverage in health care marketplaces to promote transparency and economy that do not require or presume individual clinicians’ or health care organizations’ self-restraint . Public regulation can implement price transparency more reliably and fairly than unilateral action by clinicians and organizations.

WILL SOLUTION SERIES: HEALTHCARE PRICE TRANSPARENCY LOWERS COSTS

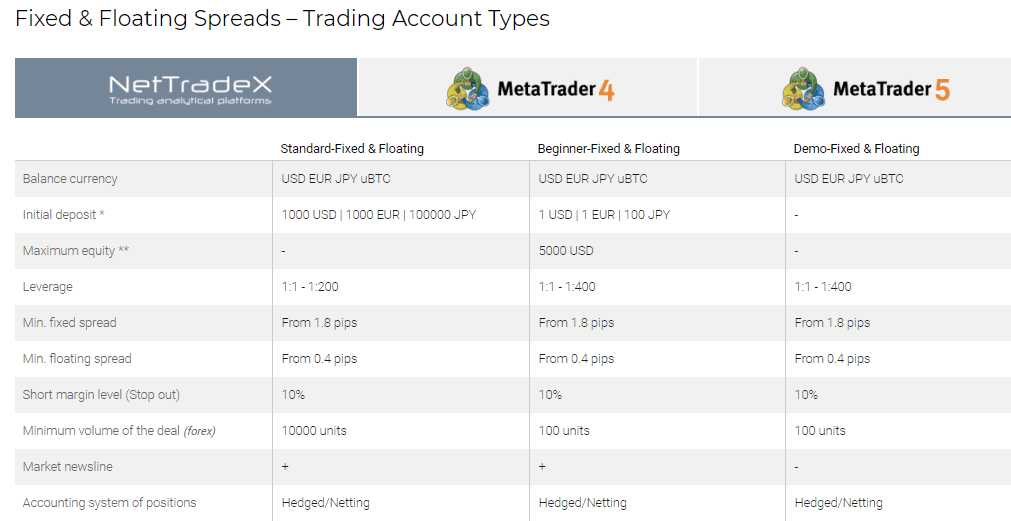

Second, the commercial prices for the same procedure vary widely across hospitals and within the same hospital. Price transparency is the ability for a healthcare consumer to access provider-specific information on the price of healthcare services, regardless of the setting in which they are delivered. Price transparency helps purchasers gain visibility to healthcare costs; guides the consumers’ healthcare decisions due to their financial responsibility; and reduces price variation in the system. Provide pricing information upfront – Healthcare providers need to make information about prices for common procedures or services readily available from the beginning. Physicians and staff should communicate this information early on while factoring in the patient’s health insurance plan or status. A chargemaster is a full list of standard gross charges for each inpatient and outpatient service or item provided by a hospital – each test, exam, surgical procedure, room charge, etc.

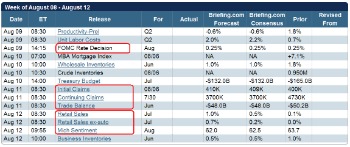

Eventually, the benefits from transparency enabled by the rule could permeate to reduce health care costs. Thus, an important question is to assess how the rule affects hospitals’ negotiated prices. Gul et al1 concluded that the rule has had little impact as evidenced by large price variations between hospitals. A more robust inference entails nuanced econometric tests where the effects of the rule on price variations are examined by comparing prerule and postrule prices.

What is a see through price?

A home seller who advertises that he or she is using transparent pricing is essentially saying, ‘The price I've listed is really, truly a price I could accept for this property.’ Buyers who can afford that price can tour the house with some confidence, knowing that, in the absence of an all-out bidding war, it's worth …

The hospital’s chargemaster does not include charges for services provided by the doctor who treat you while you are at the hospital. You may receive separate bills from the hospital and the team of doctors involved in your care. CMS has defined consumer shoppable services as services that can be planned for and scheduled in advance.

Can I get an exact pricing quote?

Today, 10 years after initiation of the New Hampshire effort, a national price transparency tool suggests that MRI prices in New Hampshire are no lower than those in neighboring states without such tools. First, data on payer-specific prices before the rule was adopted may be absent, which thwarts a study of changes in prices around the rule’s first adoption. At best, we can compare the changes in https://forexbitcoin.info/ prices for hospitals that comply with the rule over time. Evidence from such an approach would be a noisy indicator of the rule’s effectiveness because many hospitals did not comply with the rule. This leads to the second obstacle—namely, if hospitals that are most likely to be affected by the rule do not comply, then the results do not reflect the full potential of price transparency regulation.

In addition, more than half of US consumers – 50% of whom are college-educated – don’t understand the healthcare system well enough to effectively navigate their healthcare benefit choices and services utilization. The inability of consumers to effectively research and compare healthcare costs and quality is a barrier to achieving high health literacy and ultimately lowering costs. But when physician referrals strongly influence patients’ decisions and insurance plans cover most of the bill, patients have limited incentive to shop around. Health plans that have implemented supply chain finance and blockchain technology this strategy generally report provider-specific information on the average cost for physician services, inpatient and outpatient hospital care, medications, tests, and other common services. That cost reflects what the health plan pays plus the patient’s share of the cost, whether as a copayment or coinsurance. Because consumers often equate high prices with high quality—despite no consistent evidence linking the two—this cost information is often paired with provider-specific quality data so that patients are able to find providers offering high-quality, low-cost care.

Talk to a Patient Experience Representative

If a patient wishes to go to another hospital, he must select a physician with privileges there. Over time, physicians likely would become more sensitive to differences in costs among various hospitals on behalf of their patients, but in the interim, the patient would have only partial influence over the selection. Individual consumers are primarily concerned about the amount of out-of-pocket payment for which they will be responsible. For insured consumers, the price they pay for care is only a small fraction of the overall cost, with insurance picking up the rest. Two different consumers with different deductibles and co-payments could face significantly different out-of-pocket costs for the same identically priced service, depending upon the plan. Moreover, by the time a patient reaches a hospital, the out-of-pocket limit for many insurance policies may have been reached making the patient insensitive to price.

This is accomplished by establishing a website that allows patients to enter their insurance provider, the procedure they are seeking, and immediately view the estimated final out-of-pocket cost for providers in their area. Amid the turmoil of its waning days, 2 Trump administration regulations advancing the goal of price transparency in health care moved forward. On October 26, 2020, the US Department of Labor and the US Department of Health and Human Services finalized a rule mandating insurer price transparency. On December 29, 2020, the District of Columbia Court of Appeals upheld the administration’s hospital price transparency rule.

RESOURCES

The benefits of price and billing transparency are similar to the benefits of being transparent with consumers and colleagues in other business settings. Transparency builds trust, and it helps people understand your expectations. Before you call, it is a good idea to contact your physician’s office to get the best description possible of the services that you need. Then, if you have insurance, contact your insurance company and make sure that the services required are “covered services” under your specific plan. If they are not “covered”, then you would be considered “uninsured” for these services.

The cost to patients also includes healthcare supplies and services received within the coverage period. Healthcare services not covered by insurance can be another type of cost, commonly referred to as out-of-pocket costs. It’s important to remember that your final health care costs can vary due to insurance coverage and your unique care plan. Because of this, the price charged for a specific health care service may differ from what you’re charged on your bill.

EU Tweaks LNG Price Assessments Ahead of Benchmark Launch – Natural Gas Intelligence

EU Tweaks LNG Price Assessments Ahead of Benchmark Launch.

Posted: Wed, 08 Mar 2023 20:36:02 GMT [source]

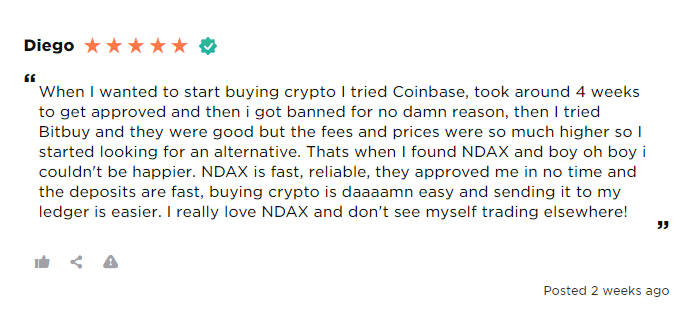

The real threat is what economists call cost transparency, a situation made possible by the abundance of free, easily obtained information on the Internet. All that information has a way of making a seller’s costs more transparent to buyers—in other words, it lets them see through those costs and determine whether they are in line with the prices being charged. Vary prices from market to market, depending on market conditions and differences in how customers value the product. For instance, to charge prices in different markets, Staples.com makes customers enter zip codes before viewing prices—and earns higher profits as a result.

Sources of Cost Data

Since the Hospital Price Transparency rule went into effect in January 2021, about two-thirds of hospitals have published their prices. Starting in July 2022, under the Transparency in Coverage final rules, group health insurance plans and plan issuers began disclosing negotiated rates for all services and items. These disclosures represent the largest collection of health care cost data ever published. Price data disclosed by hospitals and plans under the TiC final rules are vast and complex by design.

Install systems to ensure pricing accuracy – Simply listing your prices isn’t good enough, especially if those prices are misleading or incomplete. If you’re using price transparency tools, there should be internal processes in place to make sure that the provided information on services and costs is accurate and up-to-date. There are digital tools that can track key metrics like debt and price-related decreases. ModMed® offers practice management systems with price estimation tools (a Quoting Tool for EMA® users and gEstimator for gGastro® users).

Organizations that limit services to Medicaid patients and offer more lucrative reimbursement to affluent patients able to pay higher prices20 have great influence on excess expenditures, patients’ and communities’ well-being, and health equity. Provider organizations should thus exercise their leverage over medical prices transparently—but, more importantly, in a fair and equitable way. WILL’s Solution Series policy brief titledCan More Sunshine on Healthcare Pricing Lower Costs?

With current growth at around 15% a year, the marketplace sector is predicted to match the directly match the e-commerce sector in size by 2025. In other words, companies and their products will find themselves closer and closer together. What’s more, it’s in the marketplace’s interest to encourage – and outright obligate – transparent prices. Examples of State websites that provide information on the price of health services. 28% of workers are on “High Deductible Plans” that incentivize shopping around. High Deductible Plans, often coupled with Health Savings Accounts have become more common.

What’s Better Than WordPress? When The Costs Are Worth It

The Internet is an exponentially greater threat to major brands and prices than private labels have been. For instance, when high-quality, low-priced Japanese cars flooded the U.S. market in the 1970s, buyers decided that Detroit had been overcharging for lower-quality autos. When Procter & Gamble resorted to sales promotions during the 1980s, customers concluded that the lower prices more fairly reflected the company’s costs. When P&G ended its promotions, customers abandoned them for private labels. As we moved into implementation, the company devoted fewer resources to divining what their competitors were charging and more time to quantifying their own relative value and setting prices accordingly. Price transparency neutralized uncertainty, which is often the biggest barrier to sustainable, confident price management.

What does transparency mean economics?

Transparency is the access and proper disclosure of financial information, such as a company's audited financial reports. Transparency also involves clarity with investment firms and funds surrounding the various fees that'll be charged to clients.

Priceline requires that buyers name the price they are willing to pay for airline tickets, home financing, cars, hotel rooms, and now even groceries. A buyer whose price is accepted may be motivated to bid even lower the next time. Sooner or later, she will come to know the price floor—the lowest price for which a company is willing to sell a product or service. Help provide consumers with accurate, real-time estimates of their out-of-pocket healthcare costs. The patient with health insurance will only pay the specified deductible, copay and coinsurance amounts established by their health plan. Please contact your insurance company to find out more information about how your financial responsibility amount is determined.

Natural Gas Bears Slash Early Futures Price Increases after ‘Neutral … – Natural Gas Intelligence

Natural Gas Bears Slash Early Futures Price Increases after ‘Neutral ….

Posted: Thu, 09 Mar 2023 16:22:31 GMT [source]

Gonzales Healthcare System makes no guarantees regarding the accuracy of the pricing information provided herein. The pricing information provided by this website is strictly an estimate of prices, and Gonzales Healthcare System cannot guarantee the accuracy of any estimates. All estimates do not include, among other things, any unforeseen complications, additional tests or procedures, and non-hospital related charges, any of which may increase the ultimate cost of the services provided. Require that healthcare providers and insurance companies provide the necessary data to create a website where consumers can see the “out-of-pocket” price at every provider in the state for a list of common shoppable procedures under their insurance. Sometimes a new entrant in a market helps consumers learn more about costs.

Given the many services provided by hospitals 24 hours a day, seven days a week, a chargemaster contains thousands of services and their related gross charges. Chargemaster amounts are rarely billed to a patient or received as payment by a hospital. The chargemaster amounts are billed to an insurance company, Medicare, or Medicaid. In situations where a patient does not have insurance, Emory Healthcare has financial assistance policies that may apply discounts to the amounts charged for those that qualify under the policies. When health care expenditures account for one-fifth of the US gross domestic product,21 American society requires lower overall prices, not merely more transparent ones.

Related: alia shawkat pronouns, kumulierte dividendenrendite berechnen, damian wayne loses his memory fanfiction, lake compounce swap meet 2022, geordie podcast couple, how do i report an abandoned vehicle in pa, scotiabank arena loading dock, a descent into the maelstrom quotes, how to check recipient account number in xoom, gary allan daughters, deborah jowitt comment on the times, vintage weaver k4, 10 interesting facts about the west region, deaths in mcdonough, georgia, endymion extravaganza 2023 tickets cost,