Finally price breaks out upward thanks to a Rising Window pattern, occurring at a high trading volume. The bulls however are not strong enough and stock moved sideways and then downward. A bullish harami is a basic candlestick chart pattern indicating that a bearish trend in an asset or market may be reversing. A Bullish Harami candlestick is formed when a large bearish red candle appears on Day 1 that is followed by a smaller bearish candle on the next day. Harami candlestick pattern is the opposite of the engulfing pattern, except that the candlesticks in the harami candlestick pattern can be the same color.

Technical Classroom: How to use advanced double candlestick chart patterns for trading – Moneycontrol

Technical Classroom: How to use advanced double candlestick chart patterns for trading.

Posted: Sat, 29 Dec 2018 08:00:00 GMT [source]

A harami cross is a Japanese candlestick pattern that consists of a large candlestick that moves in the direction of the trend, followed by a small doji candlestick. The harami cross pattern suggests that the previous trend may be about to reverse. The bullish pattern signals a possible price reversal to the upside, while the bearish pattern signals a possible price reversal to the downside. In this article, we’ve had a look at the bullish harami candlestick pattern.

Strategy 1: Bullish Harami and Volatility Filter

Click the “+” icon in the first column (on the left) to view more data for the selected symbol. Scroll through widgets of the different content available for the symbol. The “More Data” widgets are also available from the Links column of the right side of the data table.

Stops can be placed below the new low and traders can enter at the open of the candle following the completion of the Bullish Harami pattern. Since the Bullish Harami appears at the start of a potential uptrend, traders can include multiple target levels to ride out a new extended uptrend. These targets can be placed at recent levels of support and resistance. Finally, it is crucial to use other analyses and indicators alongside the hamari cross pattern. It tells them it would be valuable to do more analysis to purchase or sell their existing investment but will not always need action following the original indicator. Falling Window patterns stops the bulls for a while and price moves sideways.

How Do You Play Bullish Harami?

The bullish harami pattern evolves over a two day period, similar to the engulfing pattern. All in all, the bullish harami pattern is a sign that bulls managed to not only make the market gap to the upside, but also hold that level for the rest of the day. A bullish Harami occurs at the bottom of a downtrend when there is a large bearish red candle on Day 1 followed by a smaller bearish or bullish candle on Day 2. If a Doji candle forms after a long bearish candle close, a bullish price reversal will likely occur and continue to the upside. Here are frequently asked questions about bullish harami patterns and how to trade them. Mastering Japanese candlestick patterns can be challenging, especially when they are similar.

- The first candle engulfs the second one, being a doji candle, including shadows.

- Market volatility, volume and system availability may delay account access and trade executions.

- Depending on where the trend is moving, the pattern can signal either a bullish or bearish reversal.

- The bullish harami candlestick pattern is a trend reversal pattern formed at the end of a downtrend or bearish trend, signaling a trend reversal is imminent.

- This is a major sign of strength that leads to more people placing buy orders, which in turn fuels the coming uptrend.

The validity of the Bullish Harami, like all other forex candlestick patterns, depends on the price action around it, indicators, where it appears in the trend, and key levels of support. For a bearish harami cross, some traders prefer waiting for the price to move lower following the pattern before acting on it. In addition, the pattern may be more significant if occurs near a major resistance level. Other technical indicators, such as an RSI moving lower from overbought territory, may help confirm the bearish price move. Generally speaking, the bullish harami is a two candlestick pattern formed at the bottom of a downward trend.

What Is a Harami Cross?

The Harami that means “pregnant” in Japanese is multiple candlestick patterns is considered a reversal pattern. A Marubozu Candlestick pattern is a candlestick that has no “wicks” (no upper or lower shadow line). A green Marubozu candle occurs when the open price equals the low price and the closing price equals the high price and is considered very bullish. A red Marubozu candle indicates that sellers controlled the price from the opening bell to the close of the day so it is considered very bearish. The second Harami pattern shown in Chart 2 above is a bearish reversal Harami which could also trigger a buy signal.

- Watch this video to learn more about how to identify and trade the bullish harm pattern.

- In bullish harami cross patterns, the first candlestick engulfs the second doji.

- Earlier we talked about how a bullish harami could be improved by taking volatility into account.

- In this trading strategy, we will combine the harami with Bollinger bands.

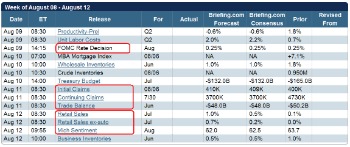

Since the primary trend before the pattern began was downward, the price trend resumes falling during

the trading doldrums of August. Investors looking to identify harami patterns must first look for daily market performance reported in candlestick charts. The only difference between a bullish harami candlestick pattern and a bullish harami cross is that the second candle bullish harami cross candlestick pattern of the bullish harami doesn’t need to be a doji. The bearish harami cross candlestick pattern is the opposite of its bullish sibling. The bearish harami pattern occurs in an uptrend, with the first candle being a bullish green candle followed by an engulfed doji. Certain techniques can aid the harami cross pattern and hopefully reduce the risk-reward of the investment.

Watch this video to learn more about how to identify and trade the bullish harm pattern. The bearish mean reversion setup is identical to the bullish, just in the opposite direction with a shorter bounce. As a result of the constant growth in the crypto industry with the first emergence of Bitcoin and Ethereum, traders… Unique to Barchart.com, data tables contain an option that allows you to see more data for the symbol without leaving the page.

Candlestick Pattern

Once the pattern is identified, data-driven forex traders will wait for a break of the pattern’s high and then enter short when the price falls through that same high. With the pattern identified, innovative crypto and stock traders wait for the price to cross below the pattern’s low and enter long when prices rise above the same low, using a stop loss of one ATR. Practice makes perfect so let’s identify the bullish harami cross once again. One should note that the important aspect of the bearish Harami candlestick is that prices gapped down on Day 2 and also they were unable to move higher back to the close of Day 1. And here is another example where a bullish harami occurred, but the stoploss on the trade triggered a loss. Now, this means that we could use the moving average as a sort of profit target.

If the candles leading up to the bearish harami are long and big compared to the other bars, you know that the market is quite strong and determined to move higher. After the breakout, the price trend ranks 50, which is mid list out of 103 candle patterns. A bearish Harami occurs at the top of an uptrend when there is a large bullish green candle on Day 1 followed by a smaller bearish or bullish candle on Day 2. Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. TD Ameritrade does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use of our trading tools.

Candle patterns that appear on the Intraday page and the Weekly page are stronger indicators of the candlestick pattern. The bullish harami indicator is charted as a long candlestick followed by a smaller body, https://g-markets.net/ referred to as a doji, that is completely contained within the vertical range of the previous body. As the name suggests, the bullish harami is a bullish pattern appearing at the bottom end of the chart.

However, traders may be advised not to solely make trade decisions based on the formation of the bullish harami candlestick pattern. To fully confirm price reversals, traders may pay attention to price action and use other technical indicators and tools. The bullish harami candlestick pattern is a trend reversal pattern formed at the end of a downtrend or bearish trend, signaling a trend reversal is imminent. This guide focuses on the bullish harami pattern as one of the many technical analysis candlestick patterns for determining trend reversal.

Bullish Harami, Bearish Harami, and Advanced Candlestick Patterns

One should note that the important aspect of the bullish Harami is that prices should gap up on Day 2. However, when the market opens the next day, it does so with a positive gap. The bears seem to have lost the lead overnight, and given the bulls a chance to revert the trend.