Although our matching service is very convenient, you don’t have to use it. Besides the possibility of exploring and comparing listings by yourself, we offer our users an additional free matching service. This means that each and every one of them knows 100% how your business works and what they have to pay special attention to. Now, let’s focus on the question of where you can find a good accountant. Subscription-based models range – again, depending on your needs and company size – from $75/month up to $1.000/month or more. Therefore it is of great importance that your accountant is always up to date.

Without proper bookkeeping, these business transactions can get lost in the sea of your own personal expenses. If your business is audited, you’ll need to disclose accurate information about your income and expenses. Keeping two separate accounts Amazon seller accounting will reduce your legal liability and better manage your taxes and business bills. The goal is to have the per unit cost be as close to the actual “all in” cost of selling as possible since this directly affects the profitability of the business.

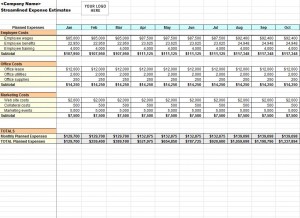

This allows you to cover all of your bases each month without spending a lot of time each week away from your regular business duties. As your business grows and scales up, your expenses should scale too. Only looking at the balance in your bank account can cause your cash flow problems, shortages on inventory, and put you in significant debt. It’s crucial to keep your personal and business finances separate. This not only makes your accounting process more straightforward but also helps ensure compliance with regulatory standards.

Still Need Help Setting Up Your Account?

If you’re not sure, take this quiz to find out which option best fits your needs. Now that you know where to find your net sales revenue, you can input it into your income tracker. By adding that net sales revenue to the same tracker as your expenses, you can quickly and easily calculate your net profit. You should also consider the “materiality” of your sales tax, or whether it is worth collecting based on how much you are selling.

- It’s also worth noting that QuickBooks interfaces with various alternative payroll services, such as Patriot Payroll, OnPay, and Gusto.

- The IRS accepts digital records, so don’t worry about hanging on to paper receipts forever.

- Do you need powerful rule building and enhanced transaction data?

- LinkMyBooks was founded by UK sellers, and is particularly valuable for managing European marketplaces, but is not seller-location specific – you can use it wherever you are in the world.

- In addition, the rates also vary from country to country, according to the accountant’s company size, your company size, and according to their professional experience.

The bookkeeper collects and organizes all documents and prepares them for the accountant. Basically, their job is to monitor the health of your business by strictly controlling profits and losses. It is sufficient for the bookkeeper to have a flair for orderliness and accuracy so that no mistakes occur in the documentation of transactions. With all the relevant data, users can stick to their financial plan and spot problems prior to any errors happening. Furthermore, the solution is to help the users to follow up with their financial status in order not to miss anything during the operation period. On top of that, you are likely to encounter many manual errors.

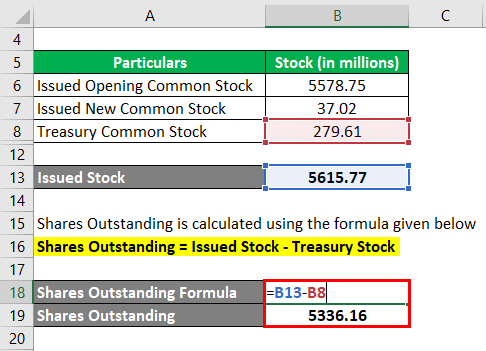

Accurate Ecommerce Accounting

If the software you use to keep track of your finances has the wrong information, those mistakes will compound over time. Double-entry accounting software, like those mentioned above, can help you with this. However, you’ll still want to run a reconciliation report at tax time to double-check your reporting. On the other hand, a professional account will cost an individual $39.99 every month. In addition to this, there are additional referral fees and variable closing fees for every sale. However, ‘professional’ sellers do not have to pay an extra $0.99 per item sold.

Paying taxes to the government is all well and good, but it’s less than half of bookkeeping and accounting. With the right knowledge, tools, and perhaps a CPA, you won’t just do your taxes correctly, you’ll better strategize your wealth and plan for the future of your business. They think all they must do is check off all their boxes, ensure they’ve filed and paid their taxes correctly, and then wash their hands of the situation until next year. Shopkeeper takes every piece of financial data into account and helps you manage and forecast your business. It helps you understand your revenue, expenses (yes, all of them), as well as your profits.

Best Rated Amazon Accounting Software For FBA Sellers

Prices start from $16 for the Simple Start edition but you would likely need to upgrade to a higher tier of $25 or $35 per month to get the functionality you need to manage your books. This price doesn’t include necessary app integrations, such as A2X which starts at $19 a month but moves to $49 per month if you have more than 200 transactions. Something I’ve found that a lot of sellers confuse is bookkeeping vs accounting. You can digitally record your expenses, income, and receipts with GoogleDrive or Dropbox. You can even add your income tracker so all your records are in one place. All you do is combine your total COGS and operating expenses and then subtract that number from your net sales revenue.

You should be sure to account for any business-related purchases where you pay for everything upfront. This includes things like office supplies, professional subscriptions, equipment, as well as travel, entertainment, and meals. Know your real-time financial situation to make data-driven decisions and solve problems proactively instead of reactively.

Denali Business (From $1999 Per Month)

Gross sales revenue would be your total sales, whereas net sales revenue is your total sales minus customer reimbursements and adjustments. If you take what you made total and subtract any refunds that you issued for returns, net sales revenue is what your business takes away after those returns. If you use a personal credit card for business purchases, then that could be okay. However, make sure that you only use that one card for business transactions and make sure that you never commingle business and personal expenses. Did you borrow money or hired products, equipment, and other business essentials? Just how much you borrowed, whom you borrowed from, what you currently owe, and when those payments come due.

Whether all you need is your accounting done right or want guidance on planning for sales tax or understanding your product COGS, Seller Accountant has you covered on all fronts. If bookkeeping isn’t the best use of your time, let someone handle it for you. Bookkeeping services are even tax-deductible, making them an excellent business decision. If and when you choose to outsource, you can hire a bookkeeper, an accountant, or a CPA to keep track of the numbers on your behalf. While bookkeepers and accountants sometimes do the same work, they have different skillsets and levels of expertise.

III. Bookkeeping for Amazon FBA Fees

By managing your accounts in small, regular increments, you can save time whilst getting to know your business better. Even with an optimized accounting stack (which we’ll explore next), it’s important to maintain your own visibility and understanding of your financials at all times. Once a proper accounting system is set up, it doesn’t take any longer to do the books, but

you get much more reliable data as a result. While spreadsheets and paper systems are a free and easy way to get started, they are really only effective for managing small volumes of data. Registering your company can protect you from certain liabilities if things go wrong, and allows you to separate your business from personal income.

Sally Beauty CEO: Gen Z Adopts BNPL, Boosts eCommerce Sales … – PYMNTS.com

Sally Beauty CEO: Gen Z Adopts BNPL, Boosts eCommerce Sales ….

Posted: Fri, 04 Aug 2023 07:00:00 GMT [source]

Our account reconciliation process will help you check all transactions in your store. With accurate financial statements in your hands, you can easily see and match payments, determine extra commissions, know which orders remain unpaid, and more. It would be best if you kept up with categorizing your transaction on a weekly or monthly basis.

QuickBooks helps you get ready for tax time too since you get to import all your transactions from your bank, sort them into tax categories and take snapshots of receipts. They consolidate your monthly statements so you can easily file your taxes at the end of the year. The bookkeepers work in-house, and they respond within one business day. The world of online retail sales tax is somewhat of a mirky one. Most professional accounting programs should offer this flexibility which becomes a key factor if you ever look to sell eCommerce businesses. To help you decide which accounting software is best for you, let’s break down each of the key categories.

It also has a suite of other tools for functions like PPC and inventory tracking whilst giving multi-currency support and allowing multiple users to access the tool. They take the time to get to know your eCommerce business and become an integral part of your team so you don’t have to worry about your bookkeeping. You can outsource this task to a trained virtual assistant bookkeeper or enlist the services of your accountant / CPA to carry out an end-to-end service for you. LinkMyBooks was founded by UK sellers, and is particularly valuable for managing European marketplaces, but is not seller-location specific – you can use it wherever you are in the world. The reality is far from that though as you are legally required to account for gross sales figures and any expenses.

$100 Billion In Eight Years: Inside Indian-American Rajiv Jain’s … – Forbes

$100 Billion In Eight Years: Inside Indian-American Rajiv Jain’s ….

Posted: Fri, 18 Aug 2023 10:30:00 GMT [source]

This could cause some real issues if you ever get audited by the IRS. Taking the time to do your bookkeeping more frequently helps you notice how much time and energy you are putting into your business. This will show you if you should consider hiring some help for certain aspects of the business. Keeping track of seasonal sales trends is a great way to predict how much stock you need in the coming months, particularly when heading into the festive season.